This blog is about the benefits of having a long term budget and cash flow plan.

I used to do the typical short term budget. How much will my next pay cheque be? After paying what needs to be paid, what’s left for me to spend? How much will I have available to save? Months came and went. Years came and went. I wasn’t finding as much money to save as I wanted. Although I had an emergency reserve, there always seemed to be an emergency that drained that reserve. I humbly accepted that I was one of those people living pay cheque to pay cheque.

The Urban Dictionary defines the long game as considering the future implications of current choices, thinking ahead, being deliberate and patient. I stumbled on the value of this concept when it comes to budgeting when my husband and I purchased a farm. Once I was budgeting with the long game in mind, along with having a cash flow plan, it was easy to see why it’s hard to get ahead financially using a short term budget.

Excitement Mixed with a Dash of Reality

It was with great excitement that my husband and I purchased an egg layer operation.

At the end of the first week that the farm operated under our ownership, my thoughts turned to money when the first cheques had to be written. My thinking around budgeting changed. It had to change because the reality was that a short term budget wouldn’t cut it.

Farming and personal expenses would be $4,000 to $8,000 per week. In order to cover expenses, we needed to ship 70,000 eggs per week on average to pay the bills and put food on the table.

My husband managed the operation before we bought it, so we knew only a few thousand eggs should be expected the first week after a new flock of birds arrived. For the optimal health of the birds, they shouldn’t be moved from one farm to another when in full production. Since we knew to expect low production in the early days, we had to plan financially for the birds to produce very few eggs early on.

Day 1 and Beyond

At the end of the day after our first flock arrived, my husband said, “I hope they lay more eggs tomorrow than they did today.”

I asked how many he gathered. I expected him to say 50 to 100 or slightly more. It was only day 1.

My husband’s response? “One.”

Me: “100?”

Husband: “No. One.”

Me: “One egg? Was it the Golden Egg?”

Husband: “No.”

Me: “Uh-oh.”

At the end of day 2, my husband said the birds did a bit better.

I asked how many eggs he gathered, hoping he’d say 50 to 100 or slightly more.

Husband: “They doubled production.”

Me: “There was only one egg yesterday.”

Husband: “Yes. Today there were 2”

Me: “Was one of them the Golden Egg?”

Husband: “No.”

Me: “Uh-oh.”

Day 3, the birds produced more eggs. The shipment the first two weeks was less than hoped, but things picked up after that. That flock ended up doing egg-ceptionally well.

In the meantime, we couldn’t plan on having a hen that would lay the Golden Egg. Since I knew a short term budget wouldn’t cut it, I had to take a serious look at the numbers. The mortgage had to be paid. The birds needed to be fed. My husband and I needed to be fed too. (A person can only eat so many eggs before wanting to change things up.)

Regardless of how much money came in, we needed to know what the expenses would be and have a plan for paying them. I made a list of farming and personal expenses payable each week and month, as well as expenses payable every few months and once a year. Everything from feed for the birds to maintenance on personal vehicles and farm equipment.

The Long Term Budget and a Real-Time Cash Flow Plan

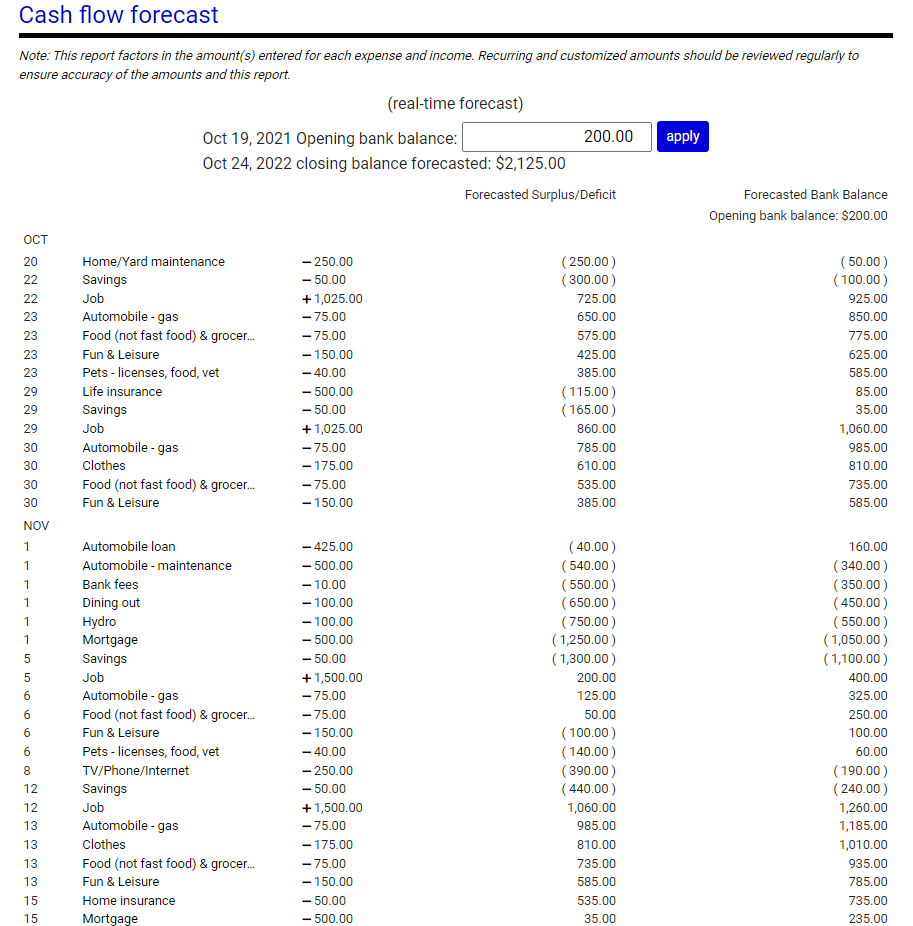

Doing a long term budget in itself wasn’t where the magic happened. The magic happened by using the numbers in the budget to create a long term, real-time cash flow plan. It became possible to predict and proactively manage potential cash crunches, which also meant inadvertently discovering a fix for problems associated with having incomes and expenses that fluctuate.

It’s not a good idea to count our chickens before they are hatched when it comes to managing money. Having a long term, real-time cash flow plan makes it possible to see when we’d be planning to spend money we wouldn’t yet have.

Considering the future implications of current choices, thinking ahead, and being deliberate were three concepts of the long game put into motion, but playing the long game in its entirety also requires patience. The patience part of the long game for me — since we didn’t have a hen that laid the Golden Egg — was in knowing my husband had a good track record for keeping hens healthy and nourished. Keeping the hens healthy and nourished — including getting enough calcium — is key in helping hens produce healthy eggs with the nice hard shells that are good for all forms of cooking.

Creating a long term budget and cash flow plan can be done using the Money Measures web browser app, which has been developed specifically for the purpose of creating a budget and cash flow plan. In our educational webinars, we teach people how to create a budget and cash flow plan using the app. https://moneymeasuresinc.com/webinars/

The Tangible Benefits of a Long Term Cash Flow Plan

A little under 10 years after budgeting with the long game in mind, the long game made it possible to expand our operation by purchasing another farm. The additional mortgage payment was added to the cash flow plan. We could make it work.

Additionally, having a long term cash flow plan made it possible to quickly and effectively reprioritize spending when and where needed. Since prioritizing and reprioritizing spending is something most of us have to do daily, having a way to do it quickly and effectively makes sense.

Applying the Long-Game Concept to Daily Living

The ability to reprioritize spending has been a necessity for just about everybody in 2020 and 2021 because of the pandemic.

I know you are likely as tired as I am of hearing the word COVID. However, anybody who experienced reduced income or had to wait for relief fund payments would have benefited from having or creating a long term budget and cash flow plan.

A fear of the unknown often goes hand in hand with being thrown a curve ball. To say people and businesses were thrown a curve ball as a result of the pandemic is an understatement. One of the benefits of playing the long game when it comes to budgeting is the ability to tally expenses quickly — making the unknown known — when we are thrown a curve ball financially.

I remember the “uh-oh” moments I experienced in the early days of our farming operation. I remember how I felt thinking about the bills that were looming. It’s due to my experience that I know it hasn’t been easy for people to manage and cope with reduced income in 2020 and 2021.

Budgeting isn’t about the next week or month and trying to squeeze what we can from a pay cheque. Playing the long game when it comes to budgeting is the way to go, which means thinking ahead, being deliberate, seeing the implications of current choices, and being patient.

Prepare for the worst case scenario. Don’t count your chickens before they are hatched. Have a budget and cash flow plan, which can include a plan for using any money that comes in that you couldn’t count on. Save it. Pay down debt. Treat yourself. Sharity.

Food Security and Nutrition

On the topic of money and eggs, it’s worth noting that eggs are an inexpensive yet nutritious meal. Here is a link to recipes for preparing some egg-siting meals for family and friends. https://www.getcracking.ca/recipes/

A little-known fact: If you like scrambled eggs that fluff up really nice, buy the small eggs.