I’ve learned there are three critical pieces of the puzzle when it comes to life goals, budgeting and a spending plan:

- A budget needs to be aligned with your life goals.

- There needs to be a spending plan that’s aligned with the budget.

- You need to know how much money is available for spending at any given time.

If any piece is missing, the budget and life goals are at risk. The risk is higher if you’re living on a fixed income and there’s not a lot of room for error.

Do you have a budget but find yourself running out of money regularly?

This can happen when there’s no spending plan that’s aligned with the budget. It can also happen when the amount of money that’s truly available for spending at any given time isn’t known.

Being short on cash periodically may not bother you if you are otherwise making progress when it comes to your life goals. However, if you are frequently running out of money and you aren’t making progress towards your life goals, it’s time to consider a new approach to budgeting.

Having a spending plan that is aligned with your life goals and budget is important. The challenge lies in creating a spending plan that’s a good fit for how you spend money and pay for purchases. Do you pay for fast food, gas, and groceries using cash or do you pay for most things using a debit or credit card? Creating a spending plan is significantly different if you use cash versus a debit or credit card.

This blog is about creating a spending plan that is aligned with your life goals and budget when cash is king and when cards are king.

When cash is king – phase 1

Are you old enough to remember how financial transactions happened before ATMs, credit cards, e-transfers and other online banking routines were the norm? I am. Here’s what I remember.

- People went to the bank once every week or two to cash a cheque.

- While they were with the teller depositing a cheque, their bank book got updated. If any funds from the cheque were on hold, the amount would be known or would get worked out.

- I remember some people leaving the teller to find a space to do some “figuring”. Moments later, the person returned to the teller to withdraw cash and have the bank book updated again.

When people did their “figuring”, they were doing a few things.

- Reconciling the current bank balance with cheques that had been written but not cashed, including pre-authorized cheques.

- Working out the total amount for upcoming bill payments so that enough money was left in the bank to cover the bill payments, including pre-authorized cheques.

- Working out how much money was left for spending, saving or for withdrawing as cash, while keeping in mind funds that were on hold and not available for spending.

Reconciling a bank balance and working out how much money was left for spending was the logical and natural thing to do.

You may not have the option of receiving job income, benefit payments and tax refunds by cheque. (And honestly, who would give up automatic payments and e-transfers if given the choice to do so?) However, nobody can stop you from having the healthy habit of reconciling your bank balance and knowing how much money is really available for spending.

When cash is king – phase 2

When cash is king, a spending plan that’s aligned with a budget gets established by default by only withdrawing money that is available for spending. (Versus going into overdraft.) The next step is using the “envelope method” for managing the money that was withdrawn. Money gets put in separate envelopes based on priorities. For example:

- Food

- Clothes

- Gas

- Entertainment

- Medications

When special occasions or holidays are on the horizon, there may be difficult choices to make about how much to put in each envelope. However, you have the opportunity to be proactive and prioritize how the money is spent.

As you take money out of an envelope, you see how much — or little — is left. It’s great being able to see what’s left because you can proactively think about how you will or won’t spend it. Make the choices that are right for you based on your priorities. The pieces of the puzzle come together nicely.

If you will allow cash to be king even now, then the traditional routine for handling money can still be followed for creating a budget and a spending plan that is aligned with the budget. Most people agree that it’s important to know where you are spending your money. This is easy to do when cash is king and envelopes are used to manage the money.

If you are a heavy user of e-transfer as well as using debit and credit cards, then the “cash is king” model for creating a spending plan will not work for you. You need to use a “cards are king” model for creating a spending plan that is aligned with your budget.

When cards are king

Banks changed how they do business with customers.

- Instant tellers replaced human tellers.

- E-transfers as well as debit and credit card transactions are now the norm for making purchases and paying bills.

- Financial institutions and retailers approve people for credit cards more readily than they did years ago.

- There used to be stringent rules to qualify for a credit card. The rules have loosened.

- Technology has made e-transfers and auto-deposits possible.

These changes make banking easier and more convenient in so many ways:

- Bills can be charged to a credit card automatically each week or month so “you don’t have to worry about missing a payment”.

- You can make payments online fast rather than taking the time to write and mail cheques.

- Auto-deposits and e-transfers mean you don’t have to go to the bank to cash cheques.

These make banking easier and more convenient. However, they also make budgeting trickier. In particular, it’s not easy to create a spending plan that’s aligned with your budget when you are pulling out the cards multiple times every day. It’s also not easy to know how much money is really available for spending at any given time.

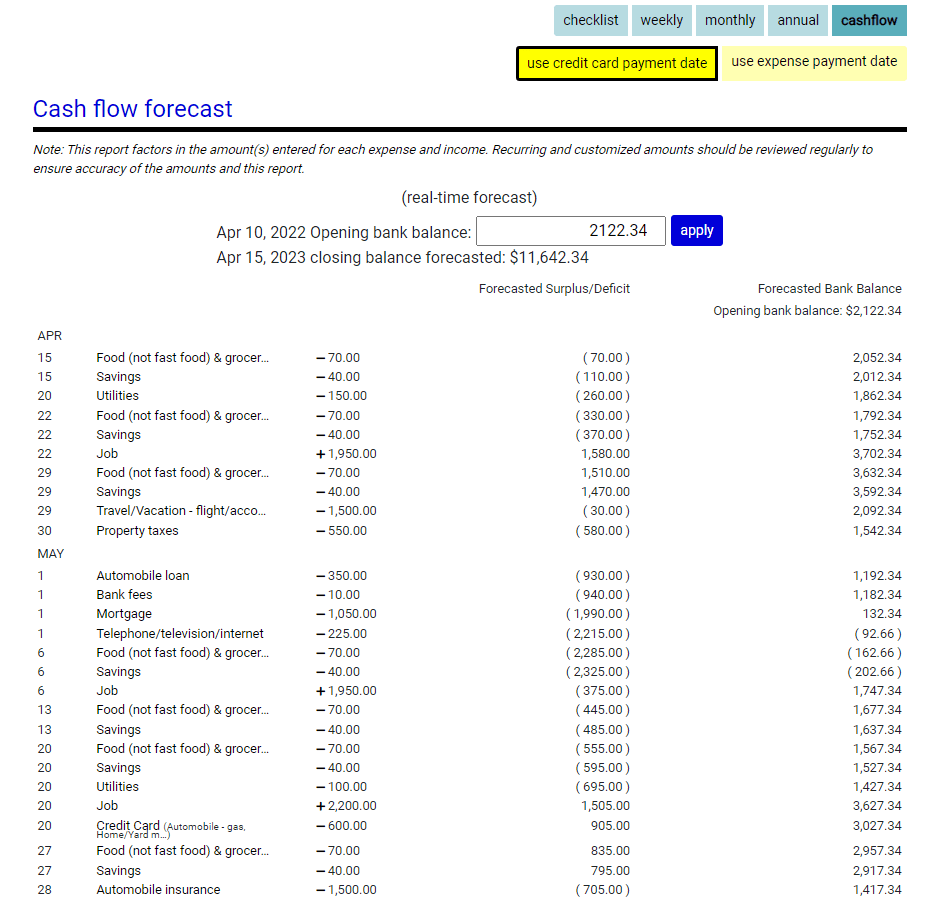

How do you create a spending plan that aligns with your budget when you make multiple stops each day that involve debit and credit card purchases? It. Can. Be. Done. It’s not easy if you do it manually, but it can be done. There is also software available that can handle the trickiest parts for you. https://moneymeasuresinc.com/ Instruction is available for using this budgeting software.

Just like a “cash is king” model, there is also a “card is king” model for creating a spending plan.

Creating a spending plan when cards are king

Here’s a summary of what the “cash is king” model looks like.

- One cash withdrawal is used to cover 10-20 purchases. Maybe more. All the purchases are accounted for when the one cash withdrawal is accounted for.

- Anytime cash is withdrawn, funds that are on hold are accounted for.

- It’s not too hard to keep tabs on how much money is in the bank and available for spending.

- When the “envelope method” for managing cash is used, the amount of money put in each envelope is based on your priorities. There is a clear link between your life goals and how money is spent.

- You know how much money is left for spending by looking in the envelopes. You can reprioritize and rejig spending easily using this method. Simply transfer money from one envelope to another.

The “cards are king” spending plan model needs to:

- Account for the purchases that are expected to be made using debit and credit cards.

- Factor in payments to be made using e-transfers, payments made at ATM’s and payments made using the online “bill payment” feature.

- Align planned spending with your life goals and budget.

- Make it possible to know how much money is in the bank and available for spending at all times. Funds that are on hold need to be accounted for.

If money is in short supply and you don’t want to use the “cash is king” model for managing the money in the bank, it’s not necessary to reinvent the wheel to create a budget and spending plan when “cards are king”. The Money Measures web app can do it all. https://moneymeasuresinc.com/ Instruction is available for getting the most from this budgeting software.

Inflation

Inflation has taken it’s toll on the finances of Canadians in 2022. According to a BDO survey, savings and discretionary spending plunged. Here is a link to the results of BDO’s survey. https://debtsolutions.bdo.ca/press-and-media/bdo-affordability-index-2022/

What are your goals for 2023? Have you thought about how you will tackle inflation and the impact it has on your life goals?

There is no time like the present to give yourself the gift of peace of mind by having a strategy for dealing with inflation. Start with creating a budget, along with a spending plan that is aligned with your budget and your life goals.

In summary

There are three critical pieces of the puzzle when it comes to your life goals and budget:

- Having a budget that is aligned with your life goal.

- Creating a spending plan that is aligned with your life goals and budget. The spending plan is your road map for staying on track.

- Knowing how much money is truly available for spending at any given time.

If these pieces are missing, you are not seeing the big picture. You are not seeing the whole picture. The picture you see is distorted. These three pieces bring the big picture into focus.

When money is in short supply, the picture you have in mind when it comes to your life goals and budget needs to be as clear and complete as possible. A clear and complete picture is possible by being very clear about what your life goals are, having a budget that’s aligned with your life goals, having a spending plan that’s aligned with your life goals and budget and knowing how much money is truly available to spend along the way.