What do identity thefts, cyber attacks, stolen credit card information, internet service interruptions and the loss of a job all have in common? Being a victim of any of these will leave you feeling violated. Additionally, any one of these will cause stress as you think about the impact on your personal finances. Having a budget and a spending plan in place in this situation gives you the information you need to get back on track quickly. It’s another benefit of having a budget.

Pre-authorized bill payments

It’s convenient to have bills paid from your bank account or charged to your credit card automatically. However, you can be left scrambling to get things back on track if you’re the victim of identify theft, a cyber attack or you have your credit card information stolen. Your bank account may be frozen. Credit cards may be cancelled. With no budget and spending plan in place, it can take a lot of time to get back on track.

- You have to work out what expenses need to be paid and what the payment due dates are.

- If your credit card is cancelled and there are expenses in the queue to be charged to your credit card, you may want to pay the bills from your bank account but aren’t sure how much money is in the bank. This may cause anxiety.

- It takes time to get your new card and get the bill payments set up to be charged to the new card.

If you have a budget and spending plan in place, use it as a checklist for what people and service providers are involved as well as what the due dates are for the payments that need to be made.

Create a budget and spending plan using the Money Measures web app. You can include the contact information for the people and service providers related to the expenses and bill payments. All the information you need is in one place. Additionally, the budget and spending plan can be printed and/or downloaded to a spreadsheet on your hard drive so you still have access to the information if there is an internet service interruption. Here is a link to the Money Measures web app. http://moneymeasuresinc.com

A personal story about credit card theft

As the saying goes, “we are creatures of habit”. Being a creature of habit has saved me time, money, and energy a few times. One time in particular stands out.

My credit card company called to ask where I had and hadn’t been recently. I was comfortable answering the questions initially because I was talking to a real person. Everything sounded legitimate. After a few more questions, though, I wondered if it was a phone scam. At some point, the company rep must have sensed my wariness about the questioning because he was quick to assure me he was from my credit card company. He said my card was flagged.

My card was used for multiple pay-at-the-pump gas purchases in a city that’s a 1-hour drive from my home. At the time of the phone call, I had never used my card for a pay-at-the-pump gas purchase. The credit card company’s computer system knew I hadn’t either. That’s why my card was flagged. I got a credit on my next statement for the gas purchases.

The credit card was still in my purse. It hadn’t been taken. The company rep told me how the credit card information was probably stolen. He said he cancelled my card and that he would send me a new one.

All it took to deal with the matter was a few minutes on the phone and some time filling out a form about the theft of my credit card information. The theft was tied to a retail chain that was targeted by credit card thieves.

With a budget and spending plan in place, it didn’t take long to work out the bill payment details for the bills paid with that card. Another benefit of having a budget.

Cyber attacks

One cyber attack can cause financial harm to a large number of people.

A school board was the victim of a “cyber incident”. An educational assistant that works for the school board said “We don’t get a paycheque through the summertime, but that doesn’t mean our mortgages stop and we don’t have to put food on the table for our families.” Here is a link to a report about the cyber incident. https://kitchener.ctvnews.ca/some-staff-not-receiving-ei-payments-after-cyber-breach-at-waterloo-region-district-school-board-1.5997554

Cyber attacks are common. They are very real and they can cause real problems. Having a budget and a spending plan in place that includes all the relevant information pertaining to expense payments can help you regain control as quickly as possible in the event of a cyber attack.

The loss of a job

How could this happen? How can this be? Is there anything I could have done? How am I going to pay the rent and put food on the table? These are just a few of the questions that come to mind when you experience a job loss.

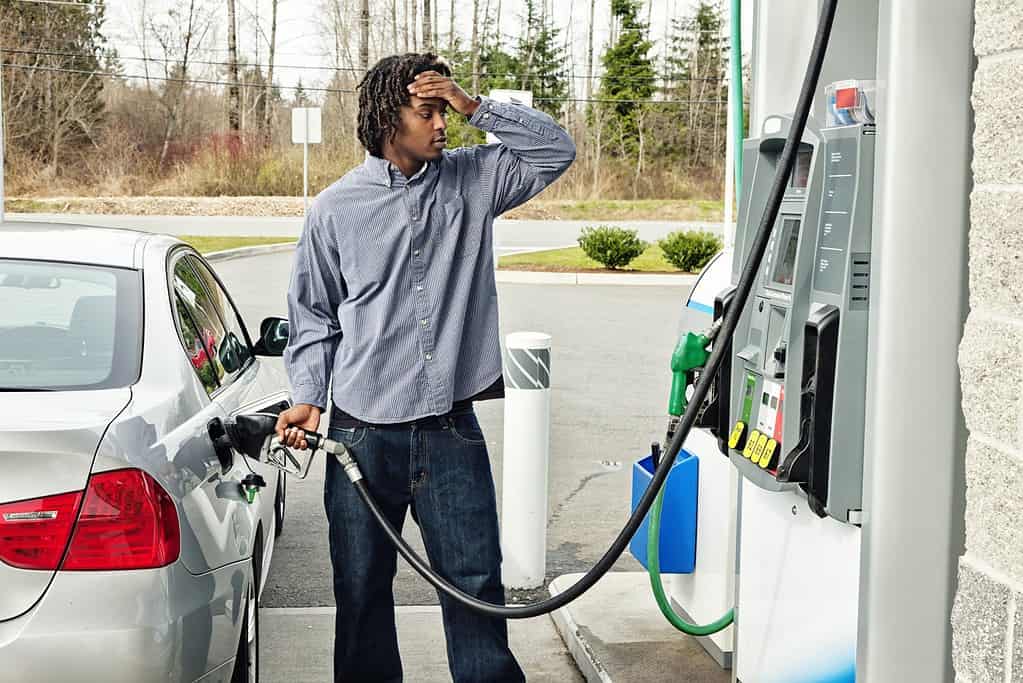

You may never get all the answers you want about how the job loss came about and whether there was anything you could have done to keep your job. However, having a budget and spending plan can help you work out what you can do to pay the rent and put food on the table – and fill up the tank with gas.

With a budget and spending plan, you can capture what the normal spending would be. You will know what money would be getting put out as well as when the money would be spent. The expenses can be tagged as being needs-based and wants-based spending. The wants-based spending can be reviewed with the goal of spending less in this area. If more spending cuts are needed, then you can look at the expenses that are necessary expenses with the goal of finding a service provider that is cheaper.

In conclusion

You can be doing all the right things to protect your identity and your money. From day to day, you keep your PIN a secret and don’t leave bank cards or credit cards strewn in plain view in your car. When you go on vacation, you have your mail delivery stopped and lock your doors. Maybe you even have a security system and you make sure you ask your credit card companies and banks to put a note on your file that you’ll be traveling.

You can do what’s in your control to do. However, life can still throw a curve ball at you in the way of identity theft, a cyber attack, the theft of your credit card information or a job loss.

Add a budget and spending plan to your list of things you should do because it’s good for your personal finances on a day-to-day basis and also because it will help you get things back on track when life throws you a curve ball. It’s another benefit of having a budget.