When bill payments are missed, financial woes can be brewing.

- Interest charges and late fees may be payable.

- If the money isn’t in the bank to pay a bill, what will you do? Will you take a cash advance on a credit card? Will you use a payday loan to get the money to make the payment? Cash advances on credit cards and payday loans cost money.

- You may rush to make the bill payment without knowing how much money you have in the bank. This may create an insufficient funds situation. NSF charges can add up.

- Your credit score can be negatively impacted.

Does this sound like you or someone you know? If so, read on to learn what can be done to prevent bill payments from being missed. Not missing bill payments can save you money.

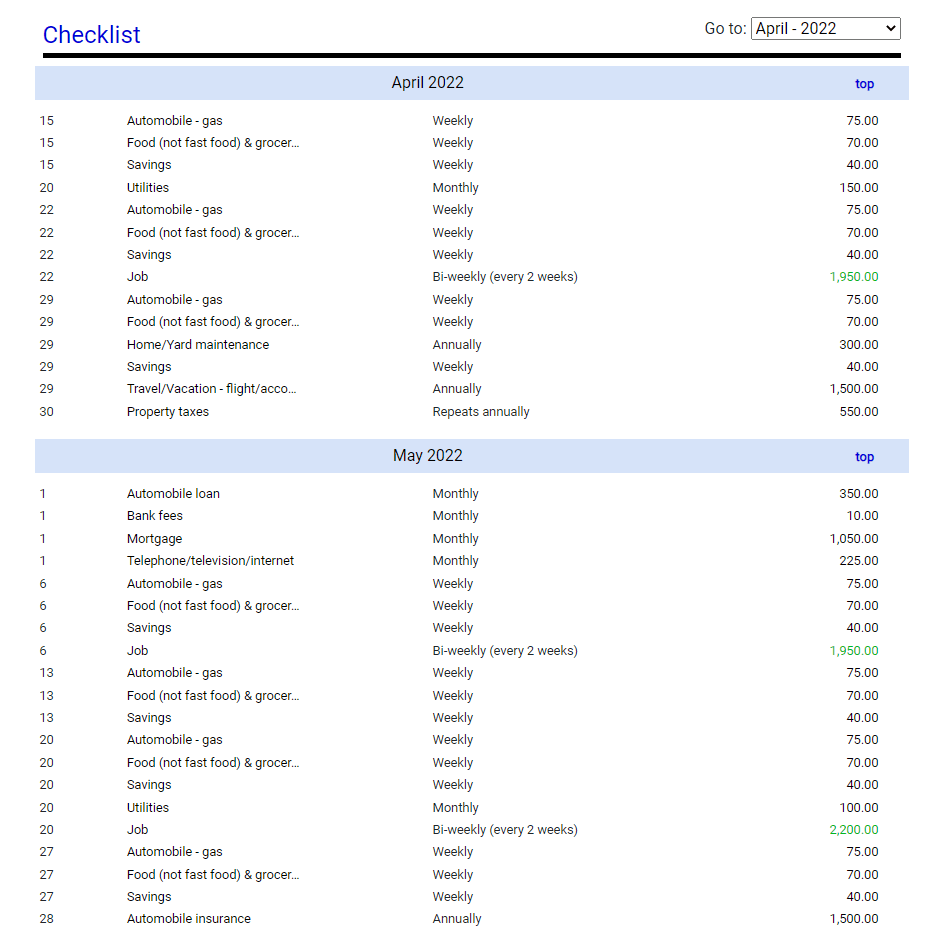

Create an income and expense checklist

When bill payments are being missed, something that can help is to create a checklist for incomes and expenses. This means you won’t be relying solely on memory about what’s coming in and going out. Here are things to consider for creating a checklist.

- Specify what the payments are for and how much the payments will be. In addition, list the due dates for the expenses and the money you’ll receive. You can use this payment information to prevent an insufficient funds situation.

- Do a checklist for each month and do it for a minimum of 13 months. This allows you to see the big picture when it comes to the money coming in and going out. Seeing the big picture makes it possible to identify times when the money coming in will be at a low or high point and when the amount being paid out will be at a low or high point.

- Include any buy-now-and-pay-later purchases that will become payable in the next 13 months.

- Interest charges and late fees should be added to the list as an expense.

Not having to rely on memory is only one benefit of doing a checklist. Another benefit is that the seemingly unpredictable becomes predictable when it comes to money.

Fluctuations in income and expenses can be planned for by creating a checklist this way. On the income side, an example is somebody who is paid hourly and gets more shifts at certain times of the year. The extra money coming in can be accounted for and planned for. For expenses, a great example is utilities which can fluctuate from season to season. Effectively managing fluctuating income and expenses can make the difference between bill payments being made rather than being missed.

Listen to the voice in your head

As you put together the checklist, listen to the voice in your head. What do you have on the go right now? What is on your to-do list for the coming year?

There will be costs related to what you have on the go. They are costs you may not think of if you create a budget the typical way. I hear people say the expenses they forget about are the periodic ones, such as having spring and fall maintenance done on a car. Even basic car maintenance can cost a lot of money and should be in the budget. If you have been told you’ll need new tires or will have to have work done on your brakes the next time you take your car in for service, you should definitely have it on the list.

Review and update the checklist regularly

Review your checklist to make sure it’s complete.

You may see an expense on the list that makes you think of another expense that should be added. For example, you may have your car loan and gas for the car on the list. You fill up regularly and you know you are making monthly loan payments. However, you may have forgotten about the periodic expenses like car insurance and maintenance. Reviewing the checklist can help you pick up on things like this.

Auto-pay

Some people have bill payments deducted from the bank account automatically to make sure payments aren’t missed. On a cautionary note, there is the potential for this to create an insufficient funds situation if you can’t be sure you’ll have enough money in the bank when the payment is scheduled to be made. NSF charges are steep. If money is tight, this is something to be aware of.

A budget and cash flow projection

If you have missed bill payments in the past and weren’t using a checklist, then doing a comprehensive long-term checklist may be all you need to get bills paid on time if money isn’t tight. You will save the money you were otherwise paying in late fees or other charges.

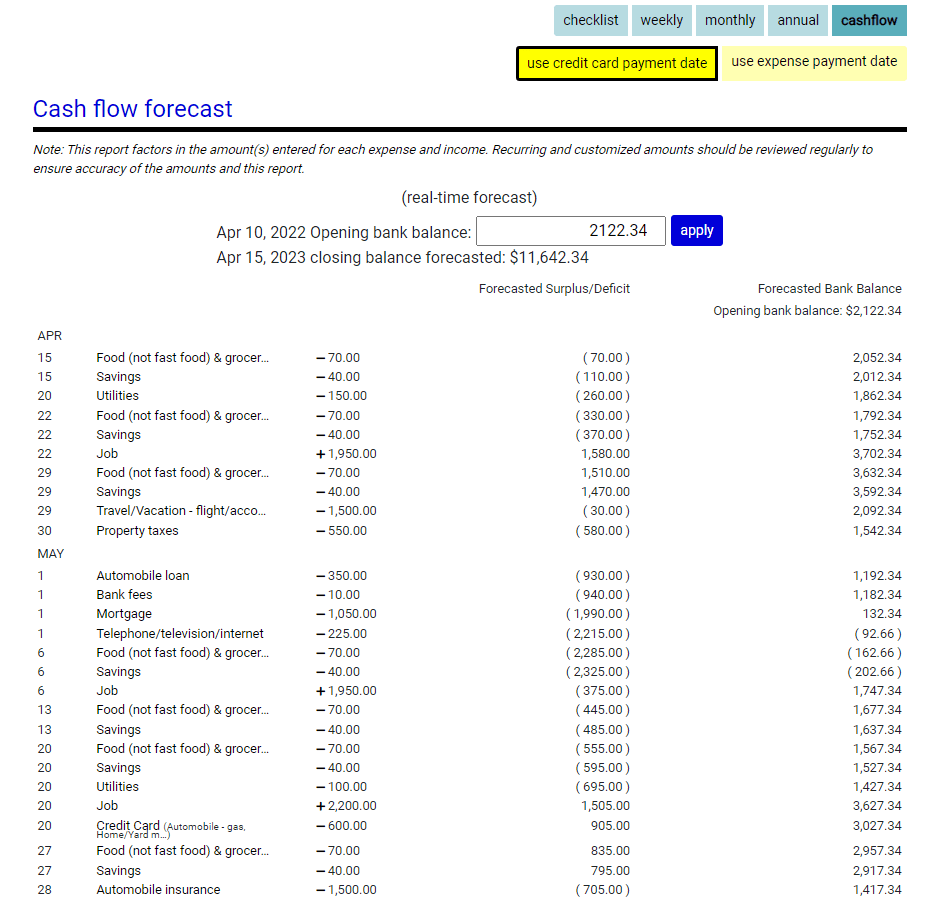

If money is tight, a checklist is a good place to start because it gives you a complete list of what needs to be paid and when. However, you’ll benefit from using your checklist to create a budget and do a cash flow projection. The budget allows you to plan to make the bill payments without spending more money than you make. The cash flow projection will identify potential cash shortfalls. You can address the potential shortfalls and make choices that will result in the best possible outcome, which will include not missing bill payments.

Do a checklist, budget and cash flow projection using a web app

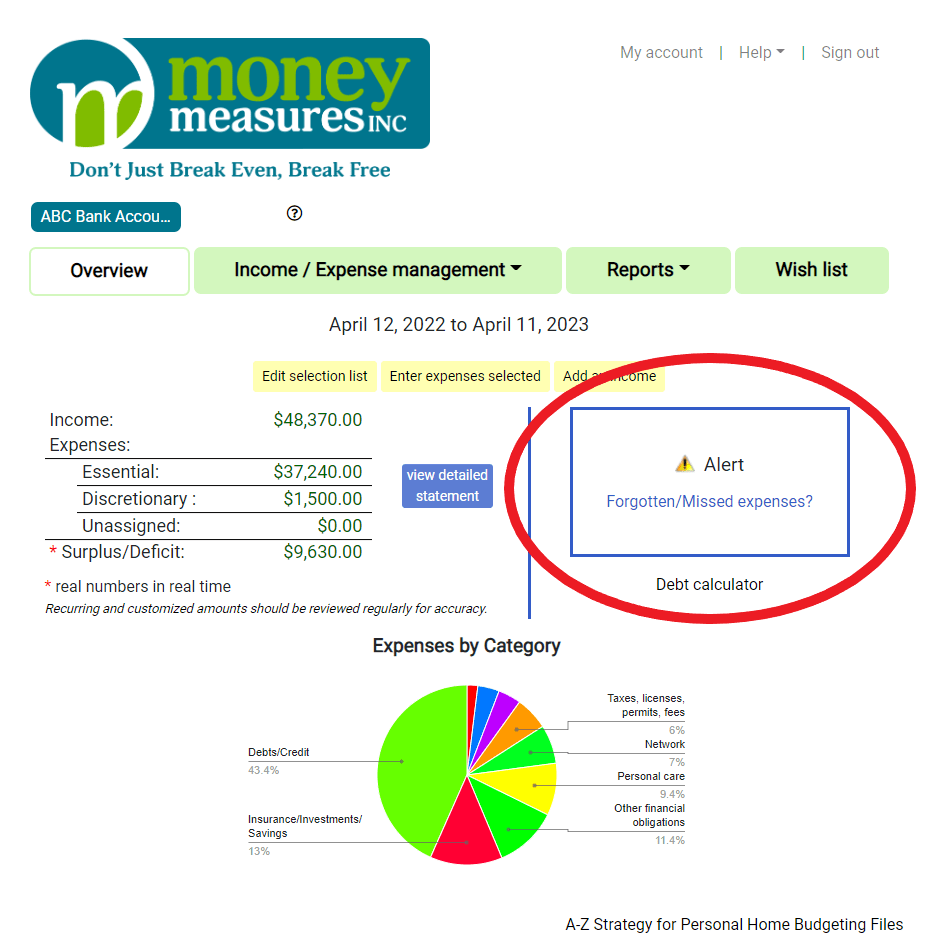

You only need to enter or change income and expenses into our web app once to get a checklist, budget, and cash flow projection that uses current information.

- You can specify if a payment is a 1-time payment or whether payments are ongoing. For ongoing payments, you can specify an end date if the payments won’t go on forever, such as for a student loan, mortgage payment or car loan. The app will remember.

- Once you enter expenses, there is an alert system for detecting expenses that may have been missed or forgotten.

The checklist, budget and cash flow projections can be printed. The checklist is a visual reminder of when payments are due. When you have created a budget that will help you reach your goals, having a printout of your budget and cash flow projections will motivate you to stick with it.

Put it all to the test. If you don’t have an account, create a Money Measures account and try it for free for 30 days. http://moneymeasuresinc.com

- Watch the how-to video.

- Enter the income and expense payments that come to mind and take a look at the checklist for each month in the coming year to see if any other expenses come to mind.

- Check the “Forgotten/Missed Expenses” alerts.

- Think about your to-do list for the coming year. Does anything on the list remind you of any expenses you haven’t accounted for?

Once you are satisfied that the checklist is complete, the Overview screen captures your total income and expenses for the coming year and you can do the cash flow projections to see if there is the potential for a cash shortfall that needs to be addressed.

Conclusion

The point of this blog is to help you avoid the financial woes that can be experienced when bill payments are missed. Having a checklist of income and expenses is definitely something that can prevent bill payments from being missed. Having a checklist:

- means less reliance on memory

- helps to make the seemingly unpredictable predictable

- can help effectively manage fluctuations in income and expenses, which means bill payments are being made instead of missed

Today is a great day to start a great habit like doing a checklist of income and expenses, creating a budgeting and doing a cash flow projection. If this is already part of your budgeting routine, then use today to do a review to see if there is anything you can do to make it even better and more effective.