November is financial literacy month, so it’s perfect timing to talk about kids and money.

Parents and teachers are major influences when it comes to how children view money, which includes how money is earned and spent.

I routinely hear the phrase “the rich get richer and the poor get poorer”. You won’t hear me promise that financial literacy will make you rich. Being rich means different things to different people. I will say that financial literacy can make the difference between being financially secure and living in comfort versus being poor and destitute. I want to do what I can to help our next generation of children be financially literate. It translates into a generation that is financially secure and living in comfort rather than continuing the cycle of of people being poor and destitute.

Whether you are a paid influencer, such as a teacher, or an unpaid influencer, such as a parent, you are very much an influencer when it comes to kids and money. As an influencer, you have an opportunity to help the next generation be financially literate.

I’m sharing my story here to show how much of an influence parents and teachers are. You’re influencing whether you’re proactively teaching or whether you’re watching kids as their skills are put to the test. I know my views about money — in other words, my financial literacy skills — were developing at a very young age.

The Early Years

I watched and I listened, because my parents and teachers all had great insights to offer about money.

Like many children, I got an allowance for doing chores. I got it before knowing the value of each coin. When my family went shopping, my mom or dad would say how many pennies, nickels, dimes or quarters it would take to get what I said I wanted.

When our teacher started having us place a dollar value on the popsicle sticks we used for learning to count, I felt empowered and grown up. One popsicle stick was one brown penny. Five equal a shiny nickel. Ten equal a shiny dime. Two groups of five popsicle sticks are the same as a dime. Five groups of five popsicle sticks equal a big quarter.

One thing that confused me is that nickels are physically bigger than dimes, but dimes are worth more money. I had to wrap my head around that one.

Back to feeling empowered and grown up. I remembered (sometimes correctly) how many coins I needed to buy something. I could now go shopping with a decision already made about what to buy based on what I was willing to pay. There was less reliance on my parents in making a purchase. My instinct was to save some of my hard-earned wages rather than going on a shopping spree that would deplete all I had earned.

Your child is watching and listening, even in the early years. If children don’t like math or aren’t good at it, there may be a lack of interest in learning the math behind the money. However, they are seeing and hearing things that influence buying choices, which is another aspect of financial literacy.

Taking It Up a Notch

Once I mastered the beginner level of making money and making buying decisions, my interest at the store became the cash register. I wanted one so I could hit a button and hear “that sound” when the drawer opened.

I asked my parents for a cash register and I got one. They didn’t ask me to help pay for it either. I put my hard-earned money into the cash register. (Putting money somewhere to earn interest wasn’t on my radar yet. I wasn’t an Alex P. Keaton.)

The cash register didn’t produce a receipt. It gave me an opportunity to hone my math skills. I created a slip with a line for each type of coin. I did individual totals for each set of coins and at the bottom, I wrote the total for all the coins. Before depositing money, I reconciled the money in the register with the receipt. After depositing my wages, I did a new receipt. When I withdrew money, the drawer of the register didn’t get closed until the amount in the register was reconciled with the receipt.

Knowing the reconciled bank balance when making a purchase is important. It should be factored into buying decisions. This is one aspect of financial literacy that isn’t getting the attention it needs.

It was absolutely thrilling when I had enough money to exchange coins for a $1 bill. I’m not sure my parents got the same thrill I did. While I was collecting money, I wanted as many pennies as possible because having a lot of coins looked better. When it came time to trade for the $1 bill, my top priority was pitching the pennies.

Kids and money – your child is watching and listening.

Making Buying Decisions

I grew up at a time when ice cream cones came in three sizes: a nickel, dime or quarter. My dad would buy my siblings and me a nickel cone each. My dad would get a quarter cone for himself.

When my one brother asked when my dad would start buying him a bigger cone, my dad said he would never buy any of us a bigger cone with his money. If we wanted a bigger cone, we would have to chip in our own money for the difference between the nickel cone and the size we wanted. A nickel is what he would pay. I remember liking every ice cream cone, which means if I ever did chip in some of my own money, I figured it was worth it.

In case you’re wondering, my parents didn’t care much for whiners. I do remember whining paying off a few times. After a few years, I realized that if my parents appeared to have “caved” when I whined, it meant they could foresee me not liking the end result. I’d learn my lesson…with direct supervision. Sometimes my parents knew their stuff. In the case of the ice cream, they knew there wouldn’t be a lesson for us to learn if they gave in to the whining and bought us a bigger cone. We’d love every last lick. So they ignored the whining and taught us instead to take what you’re given. If you want more than what you’re given, earn the money to pay for it yourself.

We didn’t have much money. There are times I think they taught us lessons about money in case we didn’t earn a lot of money as an adult. My parents were definitely “waste not, want not” parents. Needs first and wants second.

Kids and Money – Build a Budget Using the Money Measures App

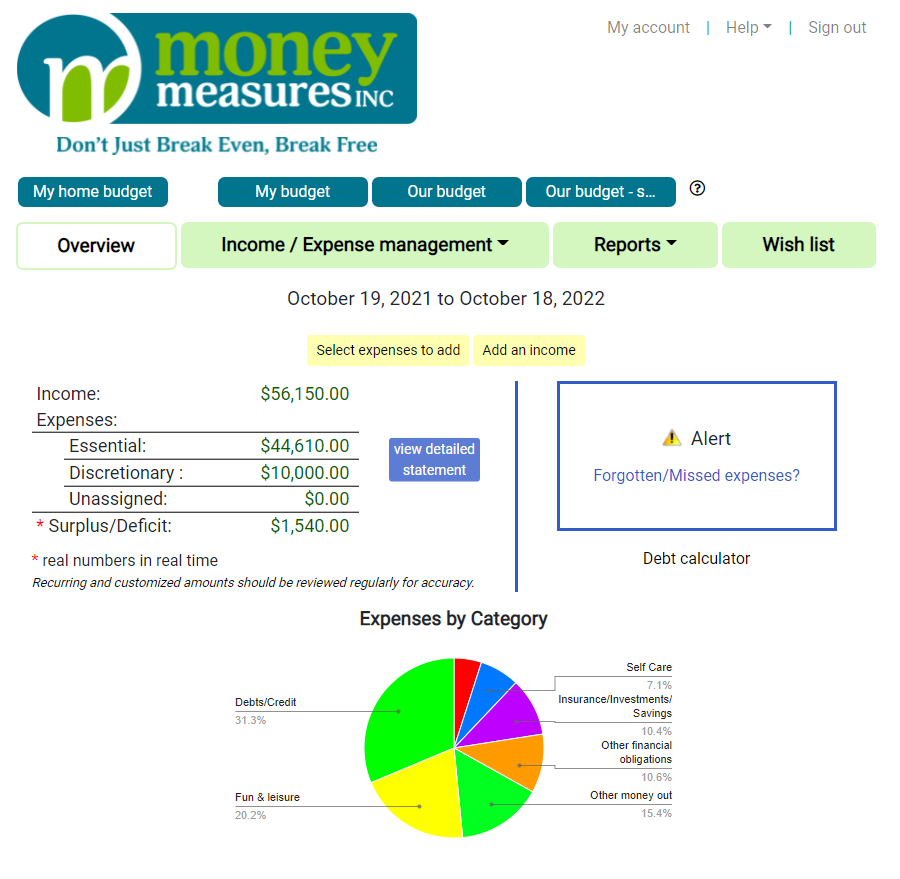

Teach your child about money earned and spending choices by using our web browser app to create a budget.

Your child will need to think about:

- How money will be earned as well as when the money will be received.

- How money will be spent and why.

- The timing of money being spent, such as buying groceries weekly and paying the rent or mortgage monthly.

Here are other features and how they are used to develop financial literacy skills:

- Expenses can be tagged as essential or discretionary, which then produces a summary of how much money will be spent on essential and discretionary expenses.

- There is a comprehensive list of expenses to choose from, which is designed to make a budget as realistic as possible.

- One of the reports available is a cash flow plan which shows how spending choices will play out in real time, including identifying overdraft situations if the planned spending will exceed money coming in.

Ten files can be created under one subscription. This makes it possible to create a different budget for different scenarios based on potential earnings and lifestyle choices.

Here is a link to create an account and try Money Measures for free for 30 days. https://moneymeasuresinc.com/

Kids and Money – On-line Resources

Here are links to videos and other information to help you teach your kids about money.

http://www.edu.gov.on.ca/eng/surveyliteracy.html

https://www.youtube.com/watch?v=1WlFoDGgQ88&ab_channel=WCLN

https://www.youtube.com/watch?v=UFCxj1Ilv6s&ab_channel=K5HiddenPeakEducation